US CMA Course details – The Certified Management Accountant (CMA) certification, offered by the Institute of Management Accountants (IMA) in the United States, is a globally recognized credential for management accounting and financial management professionals. It focuses on strategic thinking, decision-making, and financial planning skills.

Table of Contents

US CMA Course details

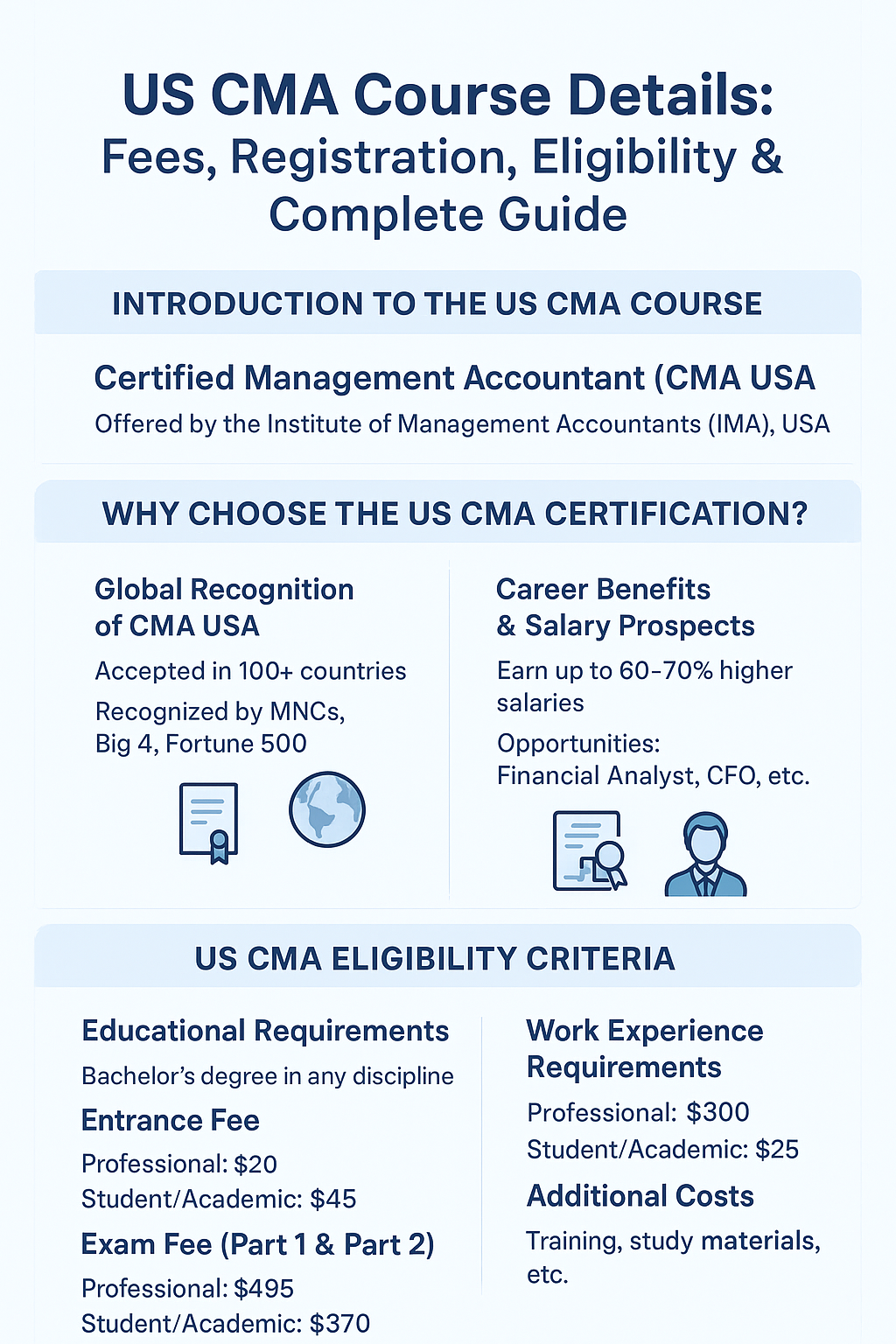

The Certified Management Accountant (CMA USA) is one of the most respected finance certifications worldwide. It is offered by the Institute of Management Accountants (IMA), USA. This certification is recognized in over 100 countries and can lead to well-paying jobs in management accounting, corporate finance, and strategic decision-making.

If you want to pursue a global career in accounting and finance, it’s important to understand the US CMA course details. This includes fees, eligibility, the registration process, and course structure. This knowledge is the first step toward success. (US CMA Course details)

Introduction to the US CMA Course

The US CMA is a professional certification that shows a candidate’s knowledge in financial planning, analysis, control, and decision support. It consists of a two-part exam aimed at testing the essential skills needed for management accounting jobs in a business setting. The program offers flexibility, enabling candidates to finish both exam parts within 14 months of their initial registration.

Why Choose the US CMA Certification?

The US CMA is known as the top credential in management accounting. It provides professionals with valuable skills like financial analysis, cost management, budgeting, and support for decision-making.

Global Recognition of CMA USA

The CMA certification is respected worldwide and recognized in over 170 countries. This makes it a great choice for finance and accounting professionals looking for international careers with multinational corporations or global capability centers.

- It is accepted in over 100 countries.

- Multinational companies, Big 4 firms, and Fortune 500 companies recognize it.

- Having this certification gives professionals an advantage over those who are not certified.

Career Benefits & Salary Prospects

CMAs usually earn higher salaries than their non-certified counterparts. Reports show that global average salaries are 20-30% higher. The certification can speed up career advancement into senior roles like Financial Analyst, Finance Manager, and Chief Financial Officer.

- CMAs make salaries that are 60 to 70% higher than those of non-certified accountants.

- Career paths include Financial Analyst, Cost Accountant, Finance Manager, Controller, CFO, and VP of Finance.

- In India, CMA USA professionals can earn between ₹7 to 15 lakhs annually, and there are international opportunities available.

US CMA Course Structure Explained

The US CMA exam has two parts. Students can complete it within 12 to 18 months.

CMA Part 1: Financial Planning, Performance, and Analytics

This part focuses on a candidate’s ability to plan, budget, forecast, and manage costs.

| Content Area | Percentage (%) |

| External Financial Reporting Decisions | 15% |

| Planning, Budgeting, and Forecasting | 20% |

| Performance Management | 20% |

| Cost Management | 15% |

| Internal Controls | 15% |

| Technology and Analytics | 15% |

CMA Part 2: Strategic Financial Management

This part assesses the candidate’s strategic decision-making and financial management skills.

| Content Area | Percentage (%) |

| Financial Statement Analysis | 20% |

| Corporate Finance | 20% |

| Business Decision Analysis (Updated Area) | 25% |

| Enterprise Risk Management (Updated Area) | 10% |

| Capital Investment Decisions (Updated Area) | 10% |

| Professional Ethics | 15% |

US CMA Eligibility Criteria

Candidates must fulfill the following criteria in order to be eligible for the final CMA certification. However, you can take the test before fulfilling the requirements for education and experience.

Educational Requirements

A bachelor’s degree from an approved college or university is necessary for admission. Degree-level credentials, like CS (India) or CA (India), are also widely recognized. The exam can be taken by students who are in their last year of graduation. After passing the CMA exams, the educational credential must be turned in to the IMA within seven years.

- a bachelor’s degree from an authorized university in any field of study.

- Candidates may also choose to pursue the CMA concurrently with graduation (approval for membership granted later).

Work Experience Requirements

A minimum of two years of continuous professional experience in management accounting or financial management is required.

- This experience can be completed before or within 7 years of passing the CMA exam.

- Qualifications include full-time employment in related fields such as cost accounting, internal auditing, budgeting, or financial analysis.

- Four years of continuous part-time employment of at least 20 hours per week is equated to two years of full-time employment.

US CMA Course Fees in Detail

Depending on whether the candidate is a Professional Member or a Student/Academic Member, the fees for the US CMA course are paid to the IMA. The IMA reserves the right to alter all fees, which are expressed in USD.

| Fee Type | Professional Member (USD) | Student/Academic Member (USD) |

| IMA Membership Fee (Annual) | $295 | $49 (Student) / $160 (Academic) |

| CMA Entrance Fee (One-time) | $300 | $225 |

| Exam Fee (Per Part – Part 1 & Part 2) | $495 | $370 |

| Total Mandatory Fees (Approx.) | $1,585 ($295 + $300 + ($495 x 2)) | $1,014 ($49 + $225 + ($370 x 2)) Export to Sheets |

Additional Costs (Training, Study Material, etc.)

Candidates should budget for other costs, including:

- Review Course/Training Fees: Can range significantly based on the provider (e.g., in India, from ₹50,000 to over ₹1,00,000).

- Study Material & Test Bank: Cost varies by provider.

- Exam Retake Fees: If you fail a part, you must re-pay the exam fee for that part.

To sum up all the costs and expenses these is a simple table for all of you-

IMA Membership Fee

- Professional Membership: $295 (approx. ₹24,000 annually)

- Student/Academic Membership: $45 (approx. ₹3,700 annually)

Entrance Fee

- Professional: $300 (approx. ₹24,500)

- Student/Academic: $225 (approx. ₹18,500)

Exam Fee (Per Part)

- Professional: $495 (approx. ₹40,000)

- Student/Academic: $370 (approx. ₹30,000)

Additional Costs

- Training institute fees (₹80,000–₹1.5 lakhs in India).

- Study material & mock test subscriptions.

US CMA Registration Process Step-by-Step

The registration process is administered through the IMA.

Choosing IMA Membership

- Visit IMA’s official Website

- enroll as an IMA Member (Professional, Student, or Academic)

- Pay the membership fee

Registering for CMA Entrance

- Pay the entrance fee after membership.

- Receive official confirmation from IMA.

- Once an active member, enroll in the CMA program by paying the non-refundable CMA Entrance Fee. This enrollment gives you 3 years to pass both parts of the exam.

Scheduling the Exam with Prometric

- Register for Part 1 and/or Part 2 through the IMA’s website and pay the respective exam fee(s).

- Once authorized by the ICMA (the certifying body of the IMA), you will receive a registration number and authorization letter.

- Use this information to schedule your specific exam date and time at a Prometric Testing Center globally.

US CMA Exam Windows & Duration

The CMA exam is held in three testing windows each year, giving candidates flexibility to schedule their exams.

- January–February

- May–June

- September–October

Each exam part is 4 hours long, consisting of:

- 100 multiple-choice questions (MCQs) (3 hours)

- 2 essay scenarios (1 hour)

You must clear both Part 1 and Part 2 within 3 years of registration.

Syllabus Coverage & Exam Pattern

The US CMA exam is highly practical, testing your analytical and decision-making skills.

Each part of the CMA exam is 4 hours long and consists of two sections.

| Section | Duration | Format | Weight |

| MCQ’s | 3 Hours | 100 Ques | 75% |

| Essay | 1 Hour | 2 Ques | 25% |

Question Types & Scoring System

- MCQs: The candidate must correctly answer at least 50% of the MCQs to unlock the essay section.

- Scoring: The exam is scored on a range of 0 to 500, with 360 being the minimum passing score for each part. Your total score is a combination of both MCQs and Essays.

- Results: Scores are typically released via email and posted to the candidate’s online profile approximately six weeks after the end of the month in which the exam was taken.

Pass Percentage & Difficulty Level

The global average pass rate for both CMA Part 1 and Part 2 is approximately 50%. The exam is considered challenging, requiring a high level of critical thinking, application, and analytical skills rather than simple rote memorization.

US CMA vs Indian CMA: Key Differences

| Features | US CMA (Certified Management Accountant) | Indian CMA (Cost and Management Accountant) |

| Governing Body | Institute of Management Accountants (IMA), USA | Institute of Cost Accountants of India (ICMAI) |

| Focus | Management Accounting, Financial Planning, Strategic Decision Making (Global focus) | Cost and Management Accounting, Auditing, Tax (Indian regulatory focus) |

| Recognition | Global (170+ countries) | Primarily India and select international jurisdictions |

| Duration | Typically 12-18 months (must be completed within 3 years) | Varies, usually 3-4 years (includes foundation, intermediate, and final levels) |

| Exams | 2 parts | 3 levels (Foundation, Intermediate, Final) with multiple papers Export to Sheets |

US CMA Coaching & Training Options in India

Many reputable institutes in India offer specialized coaching for the US CMA, including live online classes, recorded lectures, and personalized mentorship. Many of these coaching centers partner with the IMA and offer study materials from major global providers. When choosing a training option, consider the pass rate, faculty credentials (e.g., CMAs, CPAs, CAs), and the quality of the study materials and test banks provided.

At CMA GURUKUL we provide the Best US CMA classes in India Online

Most candidates prefer professional coaching for guidance-

- Online Classes: Live interactive sessions, recorded videos, test banks.

- Offline Classes: Classroom training in metro cities.

- Best institute: CMA GURUKUL

Career Opportunities After US CMA

The CMA credential opens doors to a variety of high-profile roles in finance and accounting.

Job Roles in Finance & Accounting

- Financial Analyst

- Financial Planning and Analysis (FP&A) Manager

- Cost Accountant

- Budget Analyst

- Internal Auditor

- Finance Manager

- Corporate Controller

Top Recruiters Hiring CMAs

MNCs, large domestic corporations, and consulting firms actively seek CMA professionals for their expertise in financial strategy and management. Top recruiters often include companies from the Big 4 (Deloitte, PwC, EY, KPMG) and other Fortune 500 companies.

Tips to Crack the US CMA Exam on First Attempt

- Develop a Structured Study Plan: Allocate sufficient time (recommended 300-400 hours per part) and stick to a consistent schedule.

- Focus on Application: The exam tests your ability to apply concepts, so concentrate on problem-solving and case studies rather than memorization.

- Practice Essay Questions: The essay section is crucial; practice timing yourself and structuring clear, concise answers based on the prompt’s requirements.

- Use a Quality Review Course: Choose a comprehensive study package that includes an extensive test bank and performance metrics.

- Take Mock Exams: Simulate the actual 4-hour exam environment (including the split between MCQs and Essays) to manage time and build stamina.

- Enroll in a reputed CMA coaching institute for guidance – CMA GURUKUL

What is the total duration of the US CMA course?

Most students complete it in 12–18 months, but IMA allows up to 3 years.

Can I pursue US CMA along with graduation?

Yes, students can start preparing during graduation and complete their experience requirement later.

How much does the US CMA course cost in India?

On average, between ₹1.5–2.5 lakhs, depending on training and study material.

Is US CMA valid in India?

Yes, it is highly valued in MNCs, Big 4 firms, and global companies operating in India.

Which is better: US CMA or Indian CMA?

If you aim for global opportunities, US CMA is the better option.

What is the passing rate of US CMA?

The global pass rate is about 45%, but with the right preparation, many students clear it on the first attempt.

Conclusion

The US CMA program is a strong credential that provides access to high-paying positions, leadership positions in the finance industry, and worldwide career opportunities. You can accelerate your career in corporate finance and management accounting with an investment of about ₹2 lakhs and 12 to 18 months of study.

Pursuing the CMA USA certification is a wise choice for your future if you want to work for Fortune 500 companies, Big 4 firms, or multinational corporations.

For professionals hoping to succeed in the fields of corporate finance and management accounting, the US CMA is a strategic and extremely valuable certification. It provides a route to worldwide career advancement and a notable boost in earning potential in the financial landscape of 2025, thanks to its flexible eligibility requirements and easy-to-understand two-part exam structure.

Tags used: US CMA Course details, US CMA Registration Process Step-by-Step, US CMA vs Indian CMA, career opportunities after US CMA, Tips to crack the US CMA exam on first attempt, US CMA course fees in Details, US CMA Eligibility criteria, US CMA Course structure.